r&d tax credit calculation software

Ad Pilot Takes Care Of The Entire RD Claim Process. Risk free no obligation.

The R D Four Part Test Rd Tax Credit Software

RD TAX CREDIT CALCULATOR.

. Follow up and gather more documents from anywhere. Enquire now so Lumo can fully optimise. Our RD tax credits calculator only gives a rough estimate of the potential corporation tax saving or RD tax credit payable that you may be eligible to claim.

Estimate your Federal and State RD Tax Credit with our FREE Tax Credit Calculator. The RD tax credit is available to companies developing new or improved business components including products processes computer software techniques. Get Your RD Credit Estimate.

Ad ProSeries is easy to use whenever and wherever you are with lots of time-saving features. Prepare Your RD Credit Get Cash Back. These benefits can include the following.

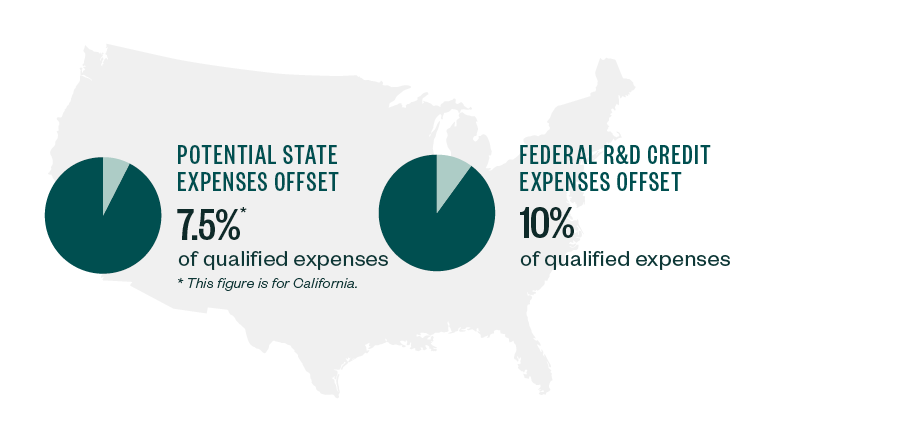

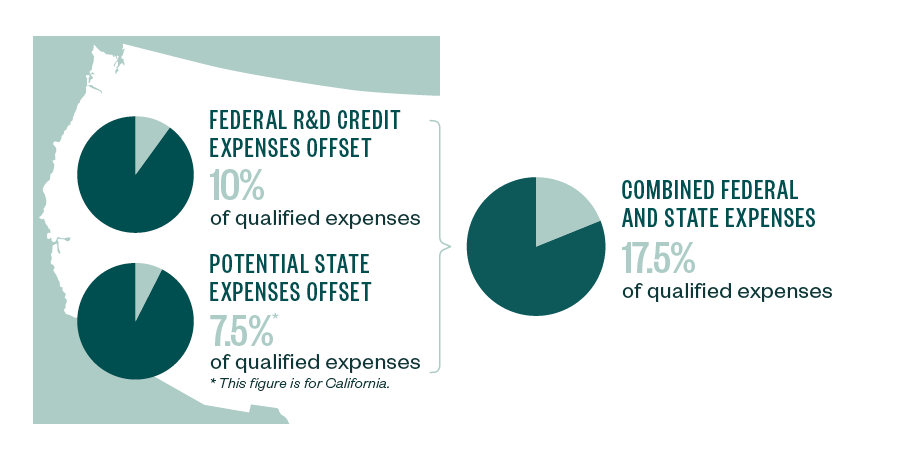

For most companies the credit is worth 7-10 of qualified research expenses. Comprehensive payroll and HR software solutions. Simply put the RD tax credit creates money that goes back into your companys pocket to fuel further innovation and growth.

RD tax credit calculation using the traditional method is based on 20 of a companys current year QREs. Call us at 208 252-5444. Tracks time and automatically sends surveys to clients.

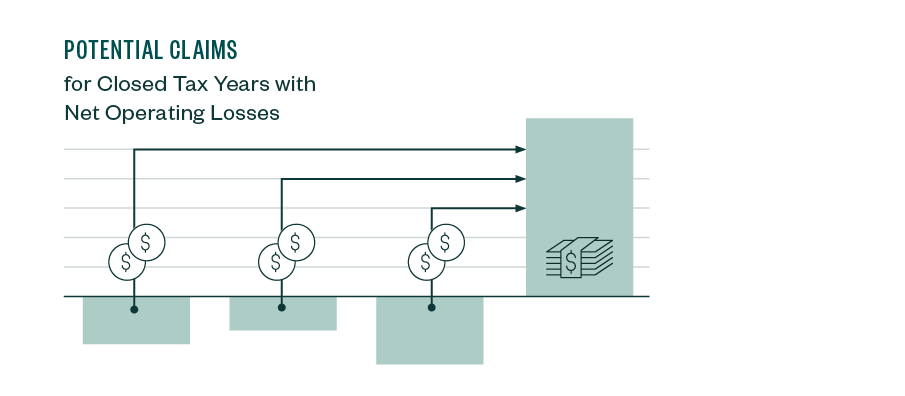

Congress addressed this disparity through legislation affecting tax years beginning in 2016. Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want. Section A is used to claim the regular credit and has eight lines of required.

Many states even provide additional credit benefits against. Save Up To 250000 For Your Business. This is a dollar-for-dollar credit against taxes owed.

Plus it carries forward. Ad Early Stage Startups Can Claim the RD Tax Credit. Estimate your RD credit with our quick calculator.

Tri-Merit Has The Technical Expertise You Need And The Flexibility You Want. The Tax Credit Calculator is indicative only and for information purposes. For software companies that meet the credit qualifications the federal benefit can exceed 10 of qualified expenses.

Software for new projects or new functionality for existing RD projects. The RD tax credit is for taxpayers that design develop or improve products processes techniques formulas or software. Our RD tax credit calculator.

Our software leads you. First file the RD tax credit on Form 6765 Credit for Increasing Research Activities which is a part of your 2021 annual corporate form 1120 US Corporation Income Tax Return. Dollar-for-dollar reduction in your federal and state income tax liability.

Cloud-based Software For The RD Tax Credit. Companies in their first five years of operations that earn less than 5. Up to 12-16 cents of RD tax credit for every qualified dollar.

Helping Qualified Businesses Significantly Reduce Their Tax Bill. Essentially a RD tax credit calculator will give you an estimate of the amount of tax credit relief that your company could receive. Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does.

What is the RD tax credit worth. NeoTax Prepares a Study and Filing Instructions for Your CPA. Ad Tax Credit Studies May Not Be Something You Do Everyday Luckily For You Tri-Merit Does.

A to Z Constructions average QREs for the past three years would be 48333. ProSeries is fueled by 1000 error-finding diagnostics and saves you time on every return. NeoTax Prepares a Study and Filing Instructions for Your CPA.

Find out how BKDs RD tax credit professionals. RD Tax credit is a non refundable amount that taxpayers subtract from their total taxable income when filing taxes. RD Tax Credit Calculator.

The credit benefits large and small companies in virtually every industry yet our research shows many businesses are leaving money on the table. Some common examples of the types of software development projects that usually qualify for RD tax relief include. If in 2022 A to Z Construction had.

The results from our RD Tax Credit Calculator are only estimated. First youll have to mark if your company is. It should not be used as a basis for calculations submitted in your tax.

Sigma Tax Pro Best-in-Class Technical Tax Prep Support For 1040 1120 Form Preparation. Fifty percent of that average would be 24167. To document their qualified RD expenses businesses must complete the four basic sections of Form 6765.

Ad Leading Professional Tax Software Best In Class Technical Support With Sigma Tax Pro. This credit appears in the Internal Revenue Code section 41 and is. Our calculator gives an accurate estimate of the potential corporation tax relief that you may be eligible to claim.

According to the Joint Committee on Taxations JCT most recent tax expenditure report the RD tax credit will reduce tax revenue by about 118 billion in 2020106 billion. For Technology Ecommerce Bio-Tech Industries More. Federal tax law provides a benefit in the form of a nonrefundable tax credit for companies that engage in qualified research and.

Ad Early Stage Startups Can Claim the RD Tax Credit. Prepare Your RD Credit Get Cash Back. The RD tax credit is available to any company investing in the development or improvement of products processes software or technology.

RD Tax Credit Calculator. The ASC approach enacted in 2006 makes this calculation a bit easier with respect to the base amount rather than utilizing information from 1984-1988 a taxpayer can now elect on an. Use our simple calculator to see if you.

Best Bookkeeping Software Our Top 10 Picks For 2022

Calculate 179d Tax Deduction With Epface Software Alliantgroup

Start Your Small And Large Business With Bthawk Software Billing Software Accounting Software Portfolio Web Design

14 Best Work Order Software In 2022 Reviews And Pricing

Tips For Software Companies To Claim R D Tax Credits

![]()

Timesheet Software For R D Tax Credits Replicon

Aircraft Maintenance Tracking Spreadsheet Aircraft Maintenance Spreadsheet Aircraft

New Home Rd Tax Credit Software

Advantages Of Using Accounting Software Zoho Books

Tips For Software Companies To Claim R D Tax Credits

Tips For Software Companies To Claim R D Tax Credits

Tips For Software Companies To Claim R D Tax Credits

2020 Tax Software Survey Journal Of Accountancy

Tips For Software Companies To Claim R D Tax Credits

R D Tax Credits For Software Development Are You Eligible What Projects Qualify

Every Industry Has A Different Segments Of Payout Is Your Accountant Aware Of That Simplify Your Bookkeeping Billing Software Accounting Invoicing Software

Software Development Industry Tax Credits R D Tax Credit

Erp For Growing Companies Sme Smallbusiness Ocean Systems Business Business Process